Weekly Roundup: Crypto Reservations

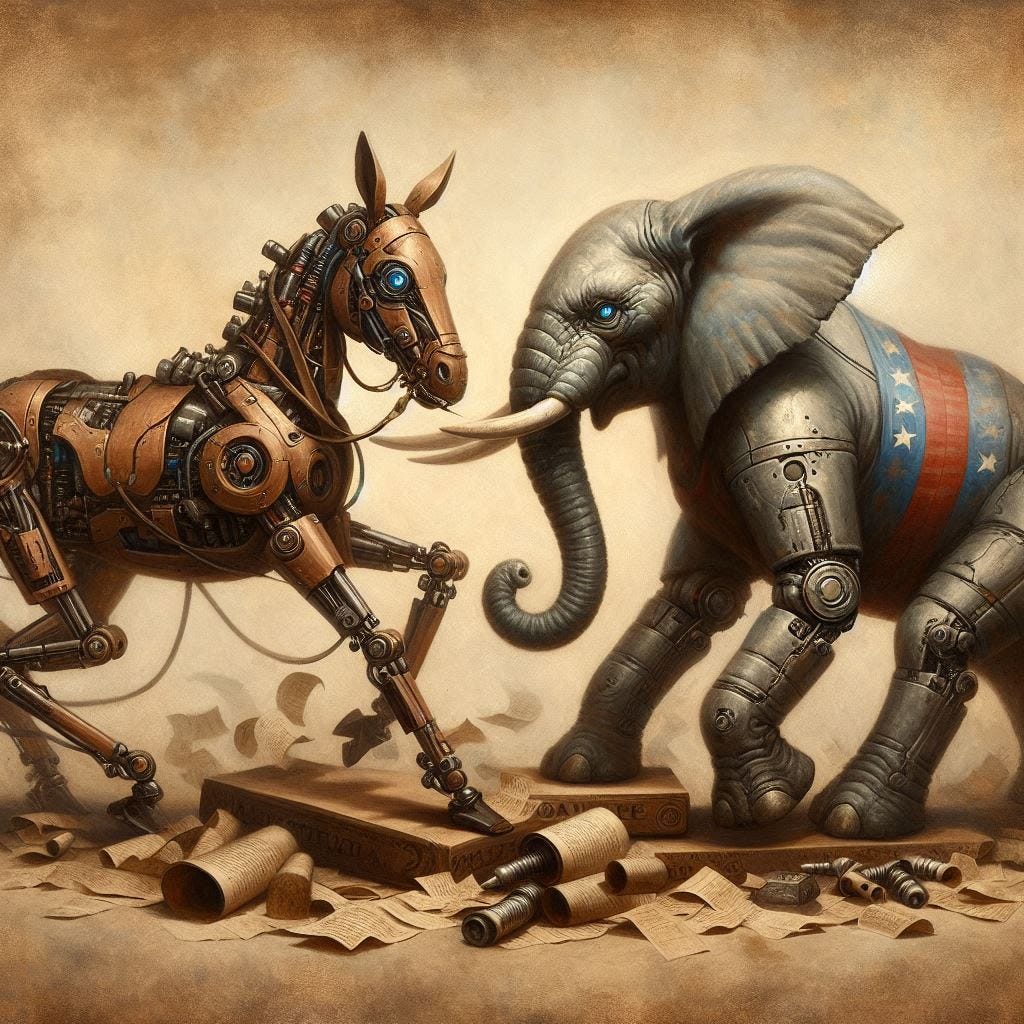

Strategic crypto reserves meet skepticism and defense of free speech is tied to the power holders

Last week, President Trump ordered the US to create a national stockpile, or strategic reserve, of crypto. The US holds about $17 billion in seized crypto assets that will become part of the initial stockpile. He also ordered “federal agencies to develop strategies to buy more Bitcoin, the most popular digital currency, as long as those purchases do not generate extra costs for taxpayers.”

“This Executive Order underscores President Trump’s commitment to making the U.S. the ‘crypto capital of the world,’” said David Sacks, the White House’s crypto and A.I. policy czar, in a post on social media. He said the United States would not sell any Bitcoin in the reserve, which he likened to “a digital Fort Knox.”

What is a strategic reserve? Well, anything you want it to be. The example most people think about is the Strategic Petroleum Reserve, which can be drawn on for all sorts of reasons, like war, natural or economic disasters, or simply to stabilize the market.

What is Crypto? Matt Levine says

What is the point of crypto? The point of Bitcoin is clear enough: It is widely used, these days, as a sort of “digital gold,” a store of value that might hedge against some sorts of risk. You buy Bitcoin not because you think it will do anything, but because you think it will retain its value. That story might annoy you, but I think it’s basically fine.

More importantly, what is so strategic about it? In a time of crisis, what value will it bring? As the US becomes less and less a stable trading partner, perhaps Bitcoin will carry more weight than the greenback in transnational transactions. As we erode the dollar’s significance worldwide, perhaps we will need crypto to bypass future sanction efforts on the dollar. This seems wise, albeit akin to laying out gauze and bandages before you shoot yourself in the foot.

Or perhaps, as many writers speculate, the President is using his position to reward those around him. The President held a Crypto Summit, inviting crypto leaders to strategize on the strategic reserve.

Noah Smith has written about crypto in this fashion in two fundamental aspects. First,

In a post back in January, I explained how memecoins — cryptocurrencies that no one thinks will ever become viable currencies, but which are linked to a specific creator whom everyone knows owns the biggest share of the coin — can basically be used as slush funds that rich people can pay into in order to buy influence.

This week, he talked about money flowing from the government to private people in the government’s inner circle:

Who stands to gain? Well, that’s the first reason crypto is such an ingenious tool for regimes to send money to favored individuals. Crypto holdings are anonymous — the public doesn’t even know who has a bunch of XRP, SOL, and ADA. But if you have a bunch of one or more of these coins, you can go whisper in Trump’s ear: “Hey man, I own a ton of Cardano.” And if you’re someone Trump wants to pay out, he can then just include Cardano in his list of cryptocurrencies that he wants the U.S. government to buy. Everyone knows that someone got a big payday, but no one knows who, except for the parties involved. Regime crypto payouts are inherently secret, even when done in plain sight.

Despite annoying roadblocks, like congressional approval for spending taxpayer dollars, the prospect of adding assets for no other reason than they are financially valuable now and might be financially valuable in the future can be taken to levels not previously seen in the US. Matt Levine, in the same newsletter linked above, writes

Why is [Solana, a relatively unknown crypto platform listed to be bought in the order] a strategic reserve asset? Why not, like, SpaceX shares? “If the United States is willing to put these tokens on their balance sheet, we should also be willing to put stock from Amazon, Facebook, Tesla, Palantir, and Gamestop,” writes crypto booster Anthony Pompliano.

The prospect of the US government owning private companies' stocks has been brought up before, most recently as a potential partial owner of TikTok. Quasi-public entities like utility companies are not particularly (legally) controversial either. On the one hand, government ownership of stocks may greatly enrich private CEOs by taking government purchases of private goods to a new level; on the other hand, it may put the government in a better legal position to nationalize corporations whose activities it doesn’t like. Scary, maybe, but it’s not like immensely powerful public servants are not deep into the stock market in the first place.

I suspect the real reason, other than the short-term profit gain mentioned above, is that it further erodes governmental power—something that fits extremely well in the new GOP worldview. Crypto is an alternative form of payment that circumvents the government. Why would a government endorse this? Well, if the democratically elected government is standing in the way between you and more power, it makes complete sense.

Inconvenient liberties

F.A. Hayek pointed out the inconvenient similarities between the far left and the right: both are “less concerned with the problem of how the powers of government should be limited than with that of who wields them.” The content moderation news this week brings that quote to life, with both Dems and the GOP identifying the correct problem, censorship, yet attacking it based on blatant party-oriented views.

House panel subpoenas Google parent Alphabet over content moderation during Biden years.

Senators Call for DOJ Probe of X’s Advertiser Pressure Campaign. “Five Democrats say Elon Musk may violate ethics and extortion rules if X uses threats to get companies back onto its platform.”

Troubling instances of unfettered access to online content causing harm to children continue to make headlines.

“AI companions” have led to suicides and provide “partners” mimicking underage celebrities.

Albania shuts down TikTok for a year, blames platform for inciting violence, bullying among children.

Utah becomes first US state to require app stores to verify user ages.

Like the last story, there seems to be general bipartisan support to try and solve this problem, yet support seems to depend on who is in power. Last year, after passing the Senate 91-3 last year, the Kids Online Safety Act didn’t get a vote in the House because Mike Johnson feared it would censor conservative views. That bill is being revived and another bill, the Take it Down Act, is moving through Congress. This bill would criminalize Nonconsensual Intimate Imagery (NCII). The usual suspects are against this bill, claiming that existing laws are fine—essentially arguing for a status quo.

For a robust opposition argument, this Verge article is good. I don’t agree with much of it, but it hits all the high points of general opposition to online safety bills. When you read it, and I hope you do, note one of the anchoring points in the author’s argument: that opposition to online safety policy is tied to who holds political power—not exactly consistent with the beliefs of free speech both sides constantly tout.

In other news:

Last week, I wrote about the extensive work-surveillance economy.

This week, “rest of world” published an article showing the international aspects of the trend: In Bangladesh, “facing competition from Vietnam and Cambodia, factories are using automation and surveillance to ramp up production and cut labor costs.”

An audit found that the 10 leading generative AI tools advanced Moscow’s disinformation goals by repeating false claims from the pro-Kremlin Pravda network 33 percent of the time.

Companies are working to move data centers into space, citing it as a solution to cybersecurity problems and massive energy consumption on Earth.

Steve Wood published another fantastic analysis on the PrivacyX Substack, which analyzes the role digital regulation will play in the upcoming US-UK trade negotiations. As the US becomes more aggressive in bilateral trading and blatantly exporting the “conservative” or “MAGA” political ideology, the points brought up in this article can probably be applied to any negotiation the US engages in during the next four years.